People keep saying that Google and Facebook get 90% of digital ad spending… though still a concerning stat, this is somewhat of a distortion. The rumor started with Mary Meeker’s Internet Trends report and has been paraphrased and rounded up. The real stat is that the duopoly gets about 90% of digital spending growth. So, as advertisers and agencies spend more on digital ads, Google and Facebook are gobbling up most of the new money. That doesn’t really make them a monopoly… it just means they’re doing a great job at keeping other companies from growing in a white-hot space.

People keep saying that Google and Facebook get 90% of digital ad spending… though still a concerning stat, this is somewhat of a distortion. The rumor started with Mary Meeker’s Internet Trends report and has been paraphrased and rounded up. The real stat is that the duopoly gets about 90% of digital spending growth. So, as advertisers and agencies spend more on digital ads, Google and Facebook are gobbling up most of the new money. That doesn’t really make them a monopoly… it just means they’re doing a great job at keeping other companies from growing in a white-hot space.

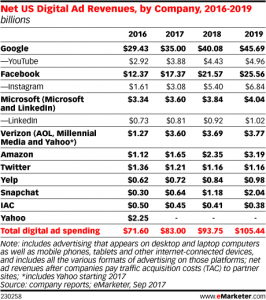

eMarketer released some reports giving us real insight into their dominance. Turns out, the duopoly has about 63.1% of the spending. Again, this should still be concerning to you if you work in advertising for anyone but Google and Facebook… but it paints a slightly more optimistic picture.

Check out their data below. Since I’m mostly concerned with market share, I’ve compiled that nicely here:

- Google 42.17% (YouTube 4.67%)

- Facebook 20.93% (Instagram 3.71%)

- Microsoft 4.34% (Linkedin 0.98%)

- Verizon 4.34%

- Amazon 1.99%

- Twitter 1.46%

- Yelp 0.87%

- Snap 0.77%

- IAC 0.54%

Here are my observations:

- Google has twice the market share of Facebook – When we say the word “duopoly” or call out 90% of growth and 60% of market share, we’re missing the fact that Google has more than twice the market share of Facebook. Put another way, Google has more market share than Facebook and all the other significant digital ad companies combined.

- Instagram vs. YouTube – By the same token, Facebook has one asset that’s whooping Google: Instagram. Without much of a video product, Instagram is still only $800M behind YouTube in terms of net revenue and the eMarketer predictions have Instagram surpassing YouTube next year.

- Photo finish for 3rd – I’m really interested in who has the best chance of eating away at the duopoly and it’s a photo-finish for third place with Microsoft and Verizon holding 4.34% of the market each. But they might not really be competitors because AOL/Verizon actually reps a lot of Microsoft’s inventory and why wouldn’t they partner to take down the Goliaths? It would be interesting if these two could start to chip away at either.

- Snapchat is slightly better off than they look – I’m bullish on Snap because I like a good underdog. eMarketer points out that while they only have .08% of the overall digital ad market, they have more than 1% of mobile and a lot more teens than Facebook and Instagram.

- And Amazon is lurking at 2% and they just started trying.

- Apple isn’t on this chart.